Part 1, discussing the first day of the release can be found here.

Part 2, discussing the experience with the market and WAXP currency can be found here.

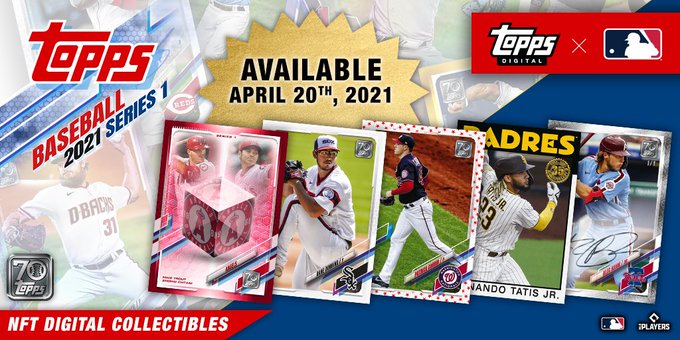

I have really enjoyed my experience after the original debacle, something that I never expected to be the case. I only own a handful of cards right now, as explained in the previous post, but its like a stock portfolio at this point. Given that I am holding and sitting on my investment, its worth while to figure out how I feel about the stakes here. Does this become a big deal like Top Shot has become, or does it settle in as another avenue to collect as a niche offering from Topps Digital? Honestly, I think this can go a number of ways, including some amazing potential for Topps that I dont think we have seen since Star Wars Card Trader took off in 2015.

Where Things Stand Now

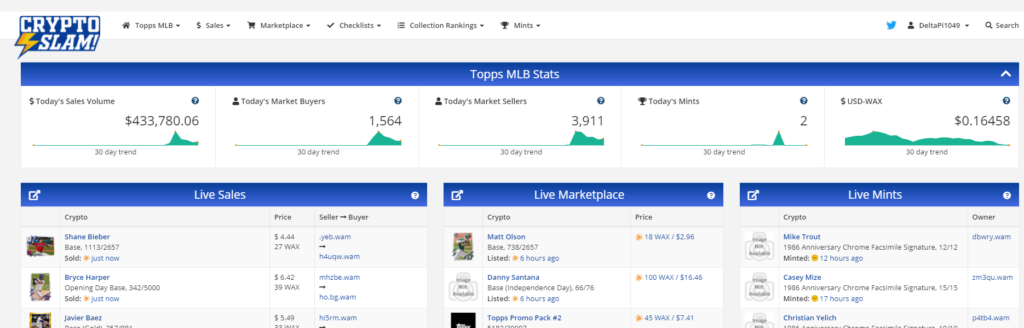

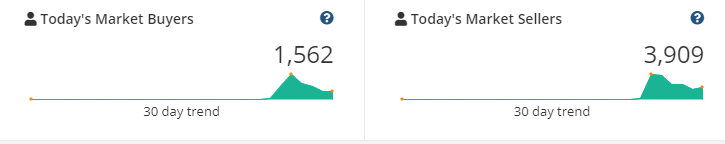

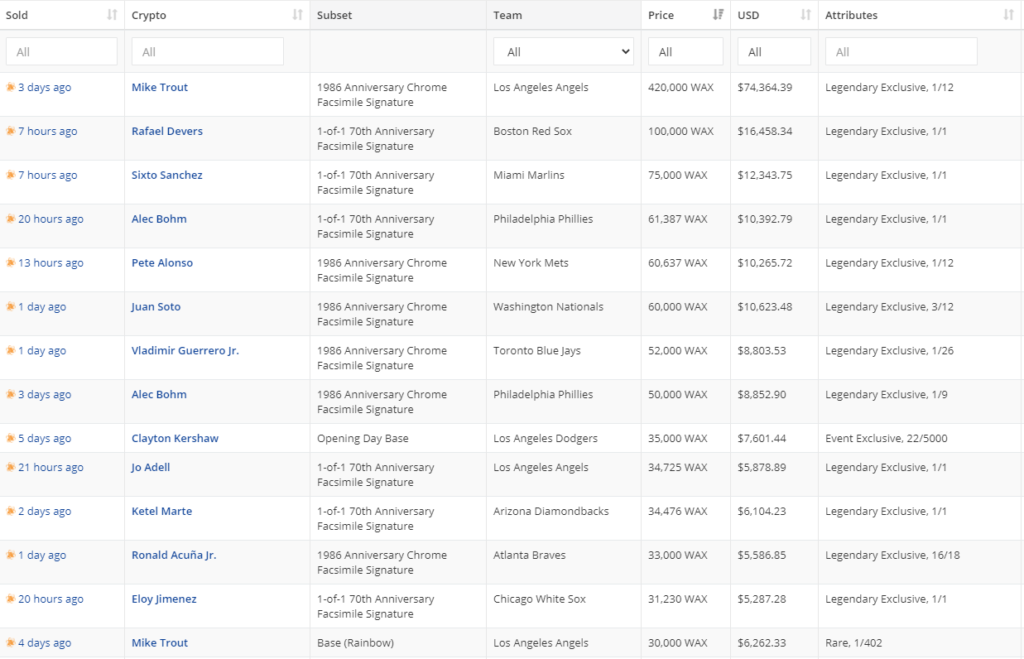

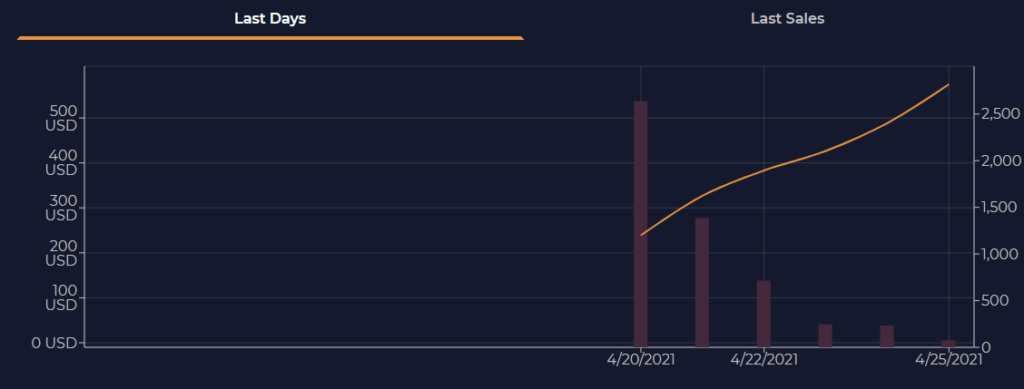

As discussed in the previous posts, very specific parts of the NFT marketplace have a trend arrow pointing straight up. There are a few factors on why this is happening, but it stems from three major things. First, the currency is FINALLY getting injected into the buying public’s wallets, and that has given people a lot of reason to finally make some purchases. Not only does this increase the cost of WAXP, used to buy all the cards on the hubs, but it has led to the first rebound in daily buyers since the market opened.

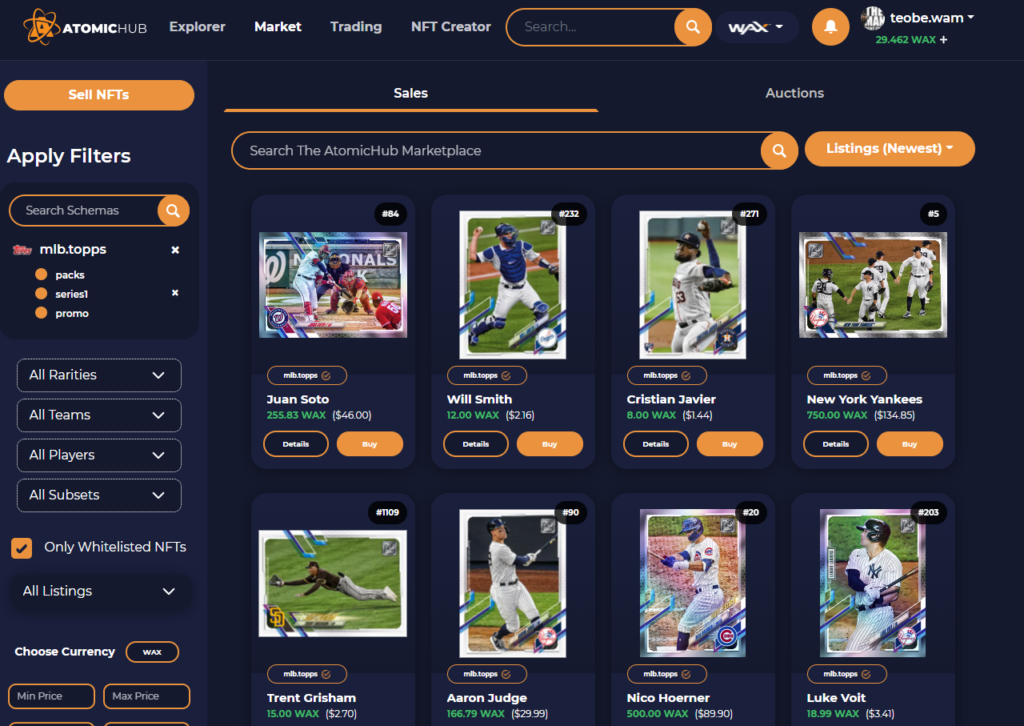

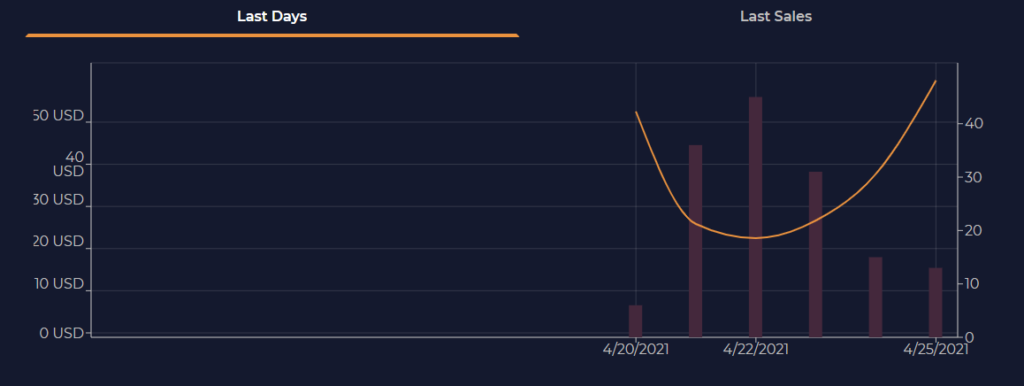

Secondly, the market prices have a lot of data for most of the readily available cards. Base card sales now have a few hundred transactions to showcase a trendline worthy of review, and even the rarer cards have established market pricing that is substantiated by a few sales. This leads to a lot more confidence in buying the individual cards, and in some cases, sets expectations that these are worthy of the value they hold.

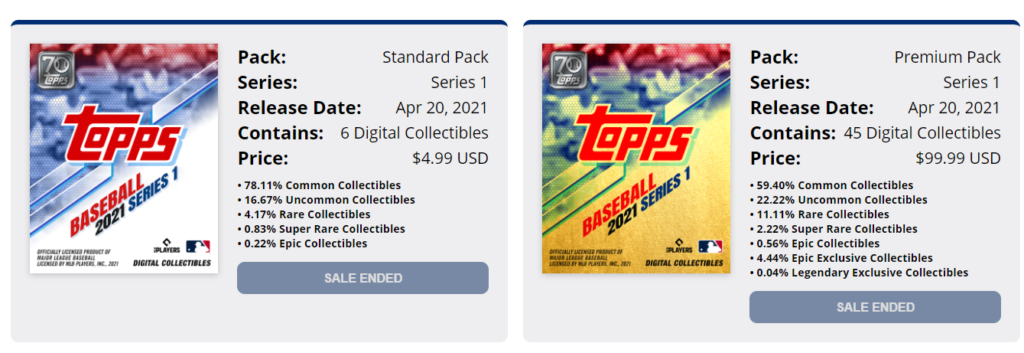

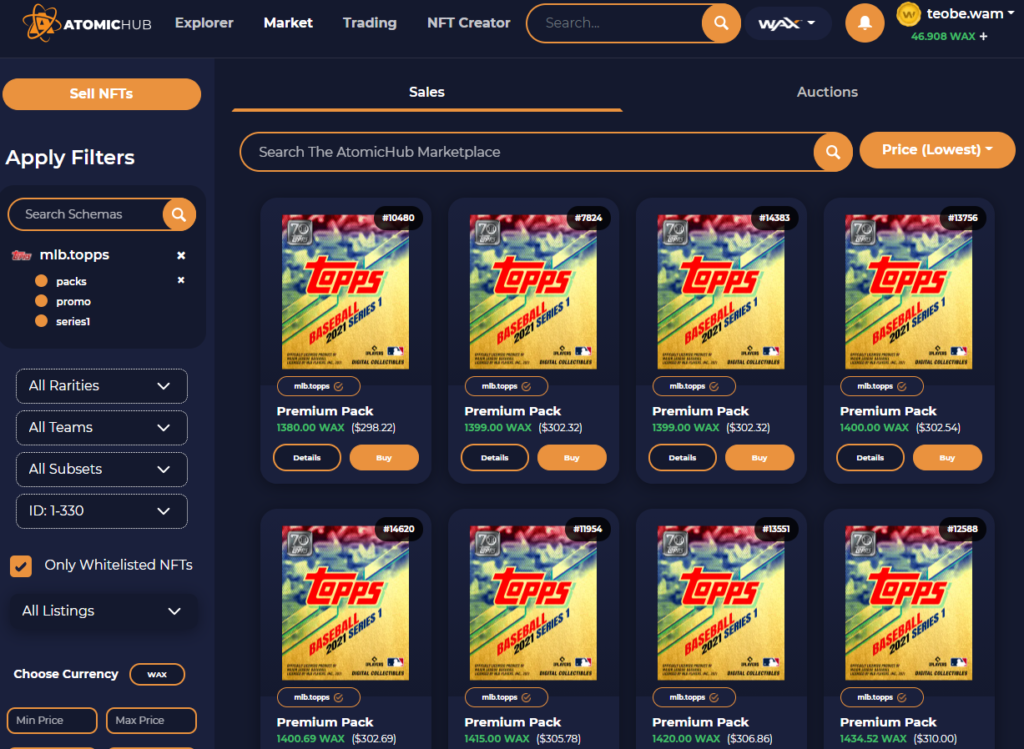

Lastly, the price of the packs has increased by a considerable margin. Just a day ago, premium packs were running 500 bucks give or take. Today they are approaching 700. Just a crazy increase there, which means that people who are keeping track are also extrapolating that value to mean the cards inside must be worth more as well.

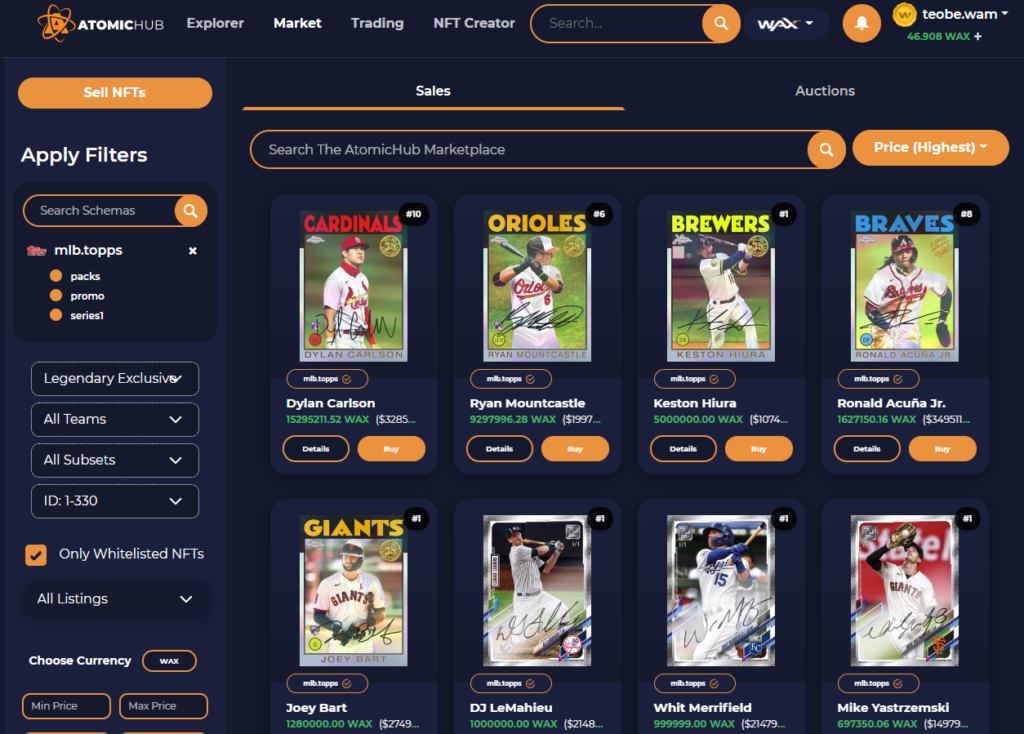

As things continue to progress, daily sales volume seems to be on a rebound, but there are still far more sellers than buyers. There are also many more people holding, so the desirable cards have less volume available. Less supply and more demand means prices spike.

Factors Preventing REAL Progress

There are a number of things that are hurdles standing in the way of the market truly taking off. Significant enough that the limitation is creating a barrier to entry for new buyers, and creating hold situations for existing users – above and beyond where they should be.

Information is the key missing factor here, as so much speculation and secondary market movement has been deflated by lack of communication from the Topps Digital team. Are more packs coming? When are more packs coming? What will those packs contain? What should we expect for other Topps brands? Will there be more sports added to the pool? Because the product is so new, and Topps has done such a poor job educating the public to spur more futures type action, things have become stunted. Pretty shocking that this could be more accelerated than it is, because its already driving so many high sales.

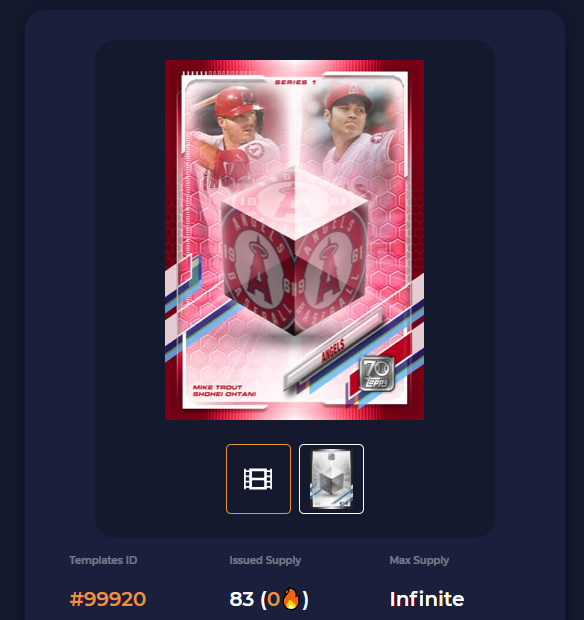

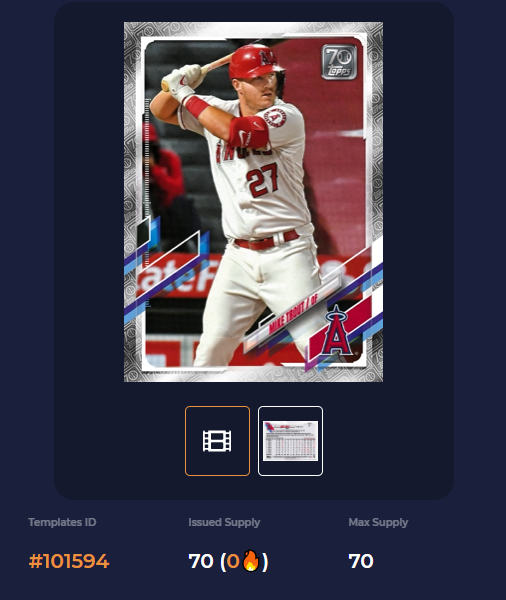

Another key factor is supply. There are a finite number of collectibles able to be transacted, and the lack of ongoing content has put certain cards into hyper drive. On the flip side, the main thing that drives a collectible market is available options, there isnt enough to sustain the lower tier of the eco system. As a result, things that should be more valuable, just arent. People are focusing on the limited supply of Trout, Tatis and Acuna, and leaving the base cards of lower tier players to be traded at very low prices. Obviously this will change, but right now, this is a limiting factor. As more sets are released, or more drops hit the market, the values will fluctuate.

The last limiting factor is currency/platform. The entire market is based on a crypto currency that doesnt have the reach that some had hoped. The organizational aspects of large collections and reporting is similarly problematic, all driven by the choice of platform. Its hard to really aggregate your personal collection in the same way that it is easy to aggregate the entire market.

I would add that all the issues driving the starvation of the buying market for available currency is also an issue, but that seems to be resolving itself as the time progresses.

What Does the Future Hold?

Thanks to the transparency of the marketplace, we can see that Topps walked away with a pretty large sum of money from this launch. Similarly, the announcement of the SPAC acquisition that specifically called out the NFT potential means that this is not a one and done release. There is more coming, likely lots more.

I still expect more Series 1 Baseball to hit the market. Not only will it add volume, but also some content that may not have been available in the original drop. New subsets, new parallels, who knows? Im guessing all of it. Not only that, but Topps releases 40 baseball products a year, give or take. If they dont convert some of those to NFT, what are we even doing here? Definitive Baseball in NFT format – yes please!

Similar to the available sets to convert, there are many other brands to bring to the platform, most notably Star Wars. I think an NFT based Star Wars collectible would almost be bigger than baseball. Given the history Topps Digital has with the brand, I think its a no brainer. I would be a homer for WWE, but I think that’s a last resort, if its even possible with the way the company has already dove into NFTs for Wrestlemania weekend.

As for the current cards, drop 1 cards will continue to be desirable over all other readily available Topps NFTs. People always gravitate to the first in a series, and even if they do another drop of Series 1, the original mint numbers will carry a hefty premium. There may eventually be 25,000 Mike Trout NFT series 1 base cards, but only the first 2500 will have that claim to being the first in the series. Think similar to the way Magic and Pokemon cards have been valued.

I also believe that we may start to see crossover with the physical products, at least we would if Topps could sort a way to blur the lines between the NFT and Physical world. They were moderately successful with it for the Topps apps in the past, but I think it was a huge missed opportunity to not go deeper. Topps has always said the divisions were separate, coming from different budgets and different teams. I think that is a horrible approach, and I think the more partnership between the divisions the better. With trading cards exploding across the entire hobby, why wouldnt you take advantage?

To close this out, Topps Digital took their original golden goose and made so many questionable judgement calls that it broke the potential of the apps almost completely. Even though we saw 30 million in revenue for the recent shareholder report, projected to be 51 million by 2021, they could have had that and more with better management of their initiatives and objectives. I hope the NFTs take off, and as a long time collector, I always love seeing new avenues to collect.